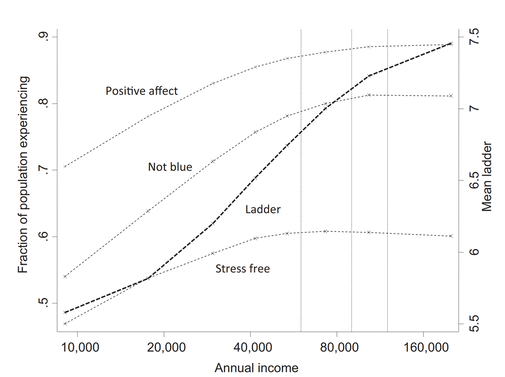

Money touches so many aspects of our lives. It influences our lifestyle, decisions, and emotions. Our relationship with money evokes a gamut of emotions including stress, greed, shame, eagerness, happiness, and joy. Depending on our season of life, money plays a role in our leisure activities, family planning, quality of life, access to resources, and even social standing. Whether we realize it or not, money acts in the background of life, greatly affecting our emotional health and well-being. Unfortunately, many of us feel trapped in our financial situations and are unsure of how to regain control over the money that seems to be controlling us. Many people spend their life pursuing more and more money, thinking they will someday reach a “happiness threshold” and stop needing more. At what point does money provide us with satisfaction instead of stress? Is there a magic number? Current research provides some clarity on this topic, and the following three blog posts will review the literature on the interaction between money and emotions. I hope this serves you and your family as you rediscover how to harness money for your joy.  Myth #1: Money Can’t Buy Happiness There is a common, age-old sentiment stating, “Money can’t buy happiness.” Although there is certainly some truth here, research suggests that money CAN buy happiness, to a certain extent. Several studies looking at happiness vs. income level have found some positive correlation between the two. However, the greatest increases in happiness occurred at lower income levels when an increase in income resulted in a greater ability to meet basic needs. For example, a family making $30,000 per year who receives a $10,000 raise may experience a significant increase in happiness due to the ability to move to a safer community and pay bills with more ease. One of the most popular studies on Money and Happiness by Nobel Prize winner, Daniel Kahneman found that increases in happiness begin to plateau between $75,000 in annual income. In other words, making more than $75,000 does not affect happiness ratings as significantly. This research also suggests that money buys only a certain type of happiness. Having certain amounts of money only correlates to happiness that is synonymous to contentment or security. In order to attain long-lasting joy in relation to money, it is important to focus on where and how our money is being utilized.  Myth #2: Buying “Things” will Bring Happiness Research shows that the best ways to gain the most enjoyment from your money is to spend it in the following ways:

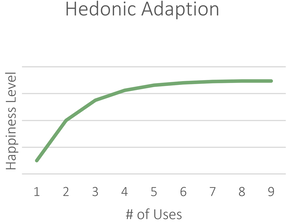

When comparing material things with experiences, experiences are more difficult to replicate and tend to be novel and exciting each time. In other words, they don’t get old quickly or lose their value to us like material goods. The study on hedonic adaption of money found that lottery winners enjoy and sudden and large influx of joy, but over time, (usually a year), return to their day to day life and often report lower levels of happiness than they had before winning the lottery. Myth #3: Giving Is Giving I mentioned above that spending money on others increases our happiness. However, the way we pursue generosity has a significant impact on the amount of happiness we derive from giving. Elizabeth Dunn concludes that the more you are able to visualize the impact of your generosity, the larger the happiness gain will be. She illustrates this by comparing giving money to a large organization like UNICEF or The Red Cross and giving to a smaller company that promises that “your $30 gift will feed 10 people a meal.” The ability to visualize your money’s impact in the latter example greatly increases your joy in giving the money away. Another way to pursue intentional giving this way is to give firsthand or face to face. Look for families in need in your community and contribute to their grocery bill, pay a debt on their behalf, or help them get their car fixed. Seeing your money’s impact firsthand has immense impacts on both the giver and receiver. Myth #4: At “This” Level I Will Be Content This is a trap that almost everyone falls for. It is the belief that reaching a certain income, money, or investment threshold will bring true happiness. Research by Michael Norton concludes that this is, in fact, a myth, and believing it may affect both your wealth and your well-being. No matter what the level of wealth, when asked in a survey how much is “enough,” every group on average stated that at least the next level of wealth would be “enough.” A study by Matthew Monnot indicate that placing a high value on increasing your income results in being less satisfied when you actually get a raise. Valuing the money as an end in itself does not result in higher levels of happiness. Valuing other factors such as experiences, giving, and time results in a higher happiness influx when income increases. “If income is important to you, then income is actually less satisfying as income goes up than if income is not important to you,” Monnot says. Comments are closed.

|

|

1701 W Northwest Hwy Ste 100

Grapevine, TX 76051 640 Taylor Street Ste 1200 Fort Worth, TX 76102 (817)-799-7699 |

|

© 2023 Flourish Financial Planning, Inc.. All rights reserved.