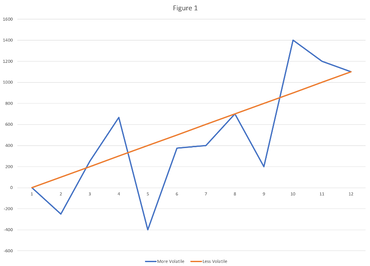

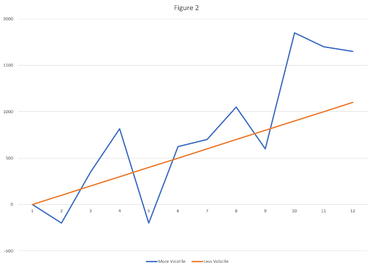

Imagine you are standing in line for a rollercoaster at an amusement park. As you’re making your way to the front of the line you see people getting off the ride. Many people are smiling or laughing, and although a few look a little dizzy or sick, overall everyone is fine. Finally, as you embark on your ride and start upwards on the first and largest hill, you start to feel a different emotion than the excitement you felt earlier while watching riders exiting the cars. You feel overwhelming and consuming fear. As your car begins to crest the large drop, you’ve completely forgotten that everyone you’ve seen has survived and even enjoyed the ride, and all you have left is a sense of fear for the peril that certainly lies ahead.  There is a striking connection between the roller coaster story and the way many of us experience and process financial news. You know that the stock market has ups and downs. You know you’ve built a solid portfolio. You know that you shouldn’t react too quickly when the stock market drops. You can reason and logic you way through these matters just prior to boarding the roller coaster, but when you reach the top of the hill and begin to descend, emotions get the best of you, regardless of what you know to be true. The stock market declines or crashes, and we find ourselves doing everything we told ourselves not to do. In this blog, I want to provide a few tools to aid you in the decision making process when the stock market is volatile and seemingly scary. For those who do not pay attention to financial news (which is a great place to be) or who do not have experience or training in this topic, here is a brief explanation: What is Volatility? Volatility, in the financial world, broadly refers to swings or changes in investment returns. On one end of the spectrum, your savings account at a bank has extremely low volatility. If you deposit one thousand dollars in your savings account, you can trust that your one thousand dollars will be there in a week, a month, a year, or even ten years (supposing you can keep your hands off of it yourself). Very little change in value in your bank account equates to low volatility. On the contrary, consider a small company’s stock. Some days (or in a bad economic time period) the company might be near bankruptcy, so your investment holds little value. In more prosperous times, the company might be making a killing, and subsequently, your investment is worth more. This is an extremely high volatility investment. For visual learners, the graph on the right (Figure 1) demonstrates a low volatility and a high volatility investment. In this case, both investments average the same return and end up in approximately the same place. It would be advisable here to choose the investment with low volatility because you can trust and rely upon it. However, this is not what it looks like in the real world.  In the real world, you are often rewarded for holding investments with more volatility with a higher return. The graph below (Figure 2) illustrates this idea. Because of the higher returns, I often advise that, “Volatility is good.” Although scary, it is beneficial in helping you achieve your financial goals. However, it is important to handle volatility carefully. What does the current situation look like? With an understanding that the stock market is going to be more volatile than our savings account (which is a good thing), why has this week come as a shock to so many people and financial news outlets? For the past few years, the stock market’s volatility has been somewhat muted. The economy has experienced slow, small growth for quite some time, which has led (along with some other factors) to far fewer swings or drops in stock market prices. Market pullbacks are not unusual, even significant ones. From 1988 through 2017, the average number of declines for the S&P 500 was one 10% decline per year, three 5% declines per year, and eight 2% declines per year. What should you do? A study by Vanguard quantified the value of financial advisors in terms of how much “excess return” they are able to gain for their clients. They broke it into different categories based on what financial advisors do for their clients including: asset allocation, lower cost investment options, rebalancing, etc. Behavioral coaching came out on top, averaging far greater returns for clients than any other service. On average, behavioral coaching from financial advisors added 1.5% to investment returns. Behavioral coaching refers to learning not to act on the emotional reaction in response to volatility in order to maintain your long-term plan. If you have a financial advisor, trust the financial plan and portfolio that they have created for your specific needs. If you don’t have a financial advisor, call me! Or, learn to think like a financial advisor. How does an advisor think? 1. Have a Plan It is natural to be reactionary in times of stress – think fight or flight reactions. The best protection against reactionary decisions is to have a plan. Decide in advance what you will do if x ,y, or z happens (brownie points if you write it out), so when you are tempted to make reactionary decisions, you can combat that urge with a proven plan. With a plan, you are much more likely to stick to reasonable, healthy investment decisions. 2. Stand Firm If your portfolio and financial plans were built to last the long haul, then it can certainly withstand short-term bumps in the market. Tune out the financial media, review your portfolio, and confidently continue on as you were before. 3. Buy Stock on Sale If there are not considerable changes in the current economic outlook, it is wise to purchase investments during a market pullback when they will be discounted. This contrarian approach to purchasing while everyone else is selling yields considerable payoff if you remember you are investing for the long-run. 4. Consider Tax Loss Harvesting As I mentioned, there are benefits of volatility. If you were already planning to making minor changes or rebalances to your portfolio, consider harvesting some of the losses in your portfolio for tax purposes. If you do this, however, you should plan to invest in similar exposure right away. This ensures that you do not leave yourself out of the market – essentially market timing. The market is guaranteed to have volatility, even if it has been quiet over the past few years, and that is a good thing. Maintaining composure during times of volatility can actually help you fare much better than others on you investment returns. Review and trust what you have set up in the “quiet times,” so you can have confidence in the chaotic ones. Like this blog post? Check out these pages...Comments are closed.

|

|

1701 W Northwest Hwy Ste 100

Grapevine, TX 76051 640 Taylor Street Ste 1200 Fort Worth, TX 76102 (817)-799-7699 |

|

© 2023 Flourish Financial Planning, Inc.. All rights reserved.