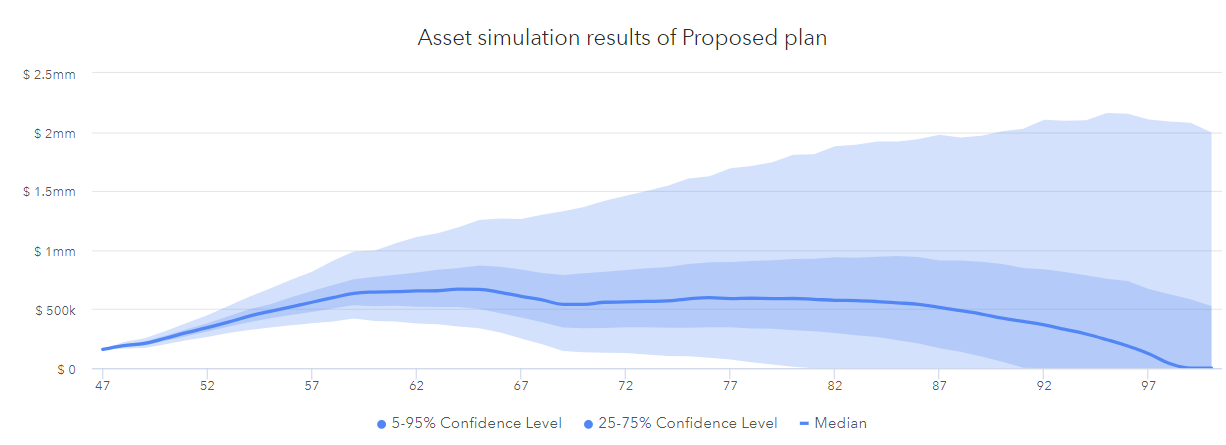

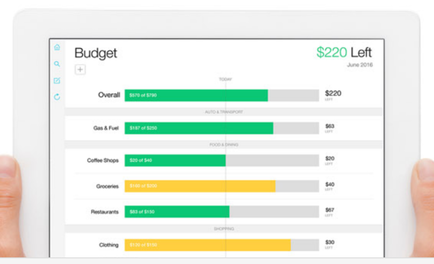

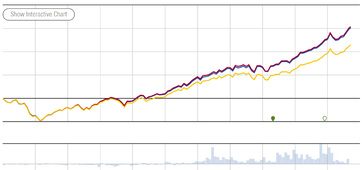

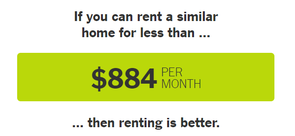

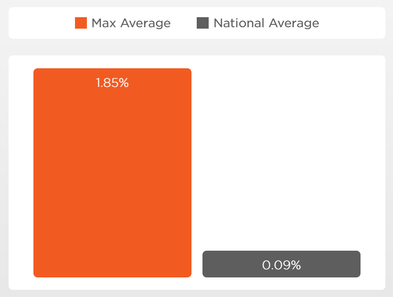

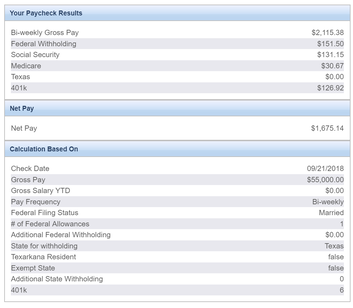

Managing your finances can be time-consuming and organizationally demanding. There has to be a way to make it easier…more manageable. Technology, including electricity, running water, and, of course, Amazon Alexa and the robot vacuum, has made our everyday lives immensely easier. Believe it or not, high quality financial technology is available to help you better plan and organize your money. This post will cover helpful automation tools you can use to take control of your finances. Disclaimer: I would like to start by stating that I do NOT have any financial interests or incentives to recommend any of the following tools/websites. My online/blog advice meets the same fiduciary standards as my financial planning practice, meaning I only recommend what is in a person’s best interest.  Cash Flow Tools Flourish FP Portal I would be remiss if I did not mention the free financial planning tool that I offer on my website. It is completely free and is the same tool that I use with my clients. Clients receive a few additional features of the tool, but the free version is definitely worth using. This tool benefits you by organizing everything in one place, so you don’t have to do the legwork of piecing together all of your information. It allows you to link your financial accounts directly to the tool where it will automatically maintain up-to-date information. Other features this tool offers include: a detailed net-worth statement, net-worth tracking over time, budgeting, and debt repayment plans. Most people’s different accounts (checking, savings, 401k’s, HSAs, etc) are somewhat fluid, and the net-worth tool allows you to easily ensure your net-worth is increasing. For example, recently, my checking account has been shrinking. This usually indicates that your financial situation is turning south, but because I had my accounts linked to this tool, I could see that my net-worth was actually increasing because my wife and I were putting more money into our HSA and retirement savings accounts. You can also take your information on-the-goal with the moble app. ***Clients of FFP have access to more features including: a lifetime cashflow projection, retirement probability of success, student loan analysis, financial stress tests and more.  Mint Mint is probably the most prevalent budgeting tool available. I have mixed opinions when it comes to recommending it. Mint is pretty in your face about its advertising partners, providing “recommendations” from their paid sponsors; in other words, their advice is biased. On the other hand, it provides a lot of helpful budgeting characteristics that aren’t available on other free tools. Mint allows you to “roll-over” your budget from month to month. This is a necessary feature when it comes to budgeting because if you overspend in one month, the tool will give you less money in that budget category the next month. If you do not spend your full budgeted amount during the month, you will have more the next month for that category. This feature is great when it comes to categories like Auto Maintenance or Travel where you might spend one large amount once per year. You can continue rolling over small amounts every month, and then when the large expense comes around, you have already saved the money for the large purchase.  Simple Bank This is not necessarily a tool but rather, an online service. Simple is a checking account backed by a lot of technology. Simple integrates your budgeting and your checking account seamlessly. Where other budgeting tools either make you enter your transactions manually or wait a couple days for the transaction to post to your account, Simple automates the entries. You can opt to get a push notification each time you use your account and categorize it at that moment. It also helps you set aside money for your monthly bills and clearly shows you what is “safe to spend” after setting aside money for your bills and goals. The downside to Simple is that it cannot be used if you spend with a credit card and pay your credit card off every month.  Investment Tools Morningstar / Valueline Morningstar and Valueline are two different sites that analyze your investments. If you are looking to evaluate different mutual funds or ETFs, I would suggest Morningstar. You can easily search the fund you are looking to evaluate by typing the ticker symbol (3-5 letters). Morningstar is an independent company that will give the mutual fund a rating up to 5 stars. When benchmarking mutual fund ratings, keep in mind it is rare to see a fund with less than 3 stars. In addition to the star rating, it also provides the fees and compares them to the average fees for other funds in that category. You can also see some of the holdings and allocations inside your mutual funds. Valueline is a similarly great tool that provides much of the same benefits, but better for evaluating stocks instead of mutual funds. It can provide you with more data-driven information to help you make your own decisions on investing in a specific company. It provides information on the company’s financials and calculates different financial ratios to help tell you the health of the company you are investing in. Finra Fund Analyzer This is a good tool to compare different funds that you are looking at. This tool uses some of the Morningstar information but allows you to visualize the information. The goal of this tool is to provide consumers with a clearer understanding of the cost of different mutual funds. Many times, fees can be hidden or hard to understand, and Finra sheds light on the topic. If you are analyzing two or three mutual funds in your 401(k) that are in the same category (eg. Large Cap, International, or Bonds), this is a great tool to use.  Risk Tolerance Assessment If you work with a financial advisor or are choosing an asset allocation, you will likely complete a risk tolerance assessment. Most risk tolerance tests are a bit short, subjective, and miss several important factors in choosing your asset allocation. A more detailed assessment is available through my website. It uses empirical research to break down your overall risk tolerance into categories of risk capacity, personality, and past experience. If you would like to take this 10-minute assessment, simply enter your email address here, and you will receive a link to take the assessment.  Business Runway If you are planning to start a business or side hustle soon, Runway IO is a great tool to use instead of excel to manage your cash flow projections. This online tool allows you to project income and expenses that you expect to have in specific months, both repeating and one-time. The tool provides visuals that present your data allowing you to see when your seed capital will run out or when you will sustain a good profit.  Wave If you have started a small business or side hustle, you will need to keep good books to make sure that you understand your profitability, have records for your taxes, and can invoice your customers. There are many tools to choose from that help you manage this yourself. I’ve tried Quickbook, Xero, and Wave, and I ended up going with Wave. (They are all great products). One of the largest benefits to Wave is the price. FREE. Most of the features are the same across all the platforms, so if you are cost conscious, Wave is a great option. The platform looks a little different than the other two, but there are many training resources and the support staff are quick to answer questions and check in on you.  Miscellaneous Buy Vs Rent Many people fall into the mindset that buying a home is an all-around, better “investment” compared to renting. This is not necessarily the case. There are many life factors that go into a decision to buy a home, but when considering the financial factors, I recommend using The New York Times calculator. When you plug in the different factors that you are considering in your home purchase, it will show you the equivalent rental price. It takes into consideration all sorts of variables including taxes, maintenance fees, closing costs, and financing costs.  MaxMyInterest Max My Interest is a great tool to help you maximize your interest rate on savings accounts. The average national bank’s interest is 0.09%, but Max My Interests partners with banks that allow you to get up to 1.9% (as of 9/20/2018). It works by working with 5 online banks that offer higher interest rates on savings accounts, your money is moved between the banks whenever one offers a higher rate than the rest. If you keep a lot of cash on hand and worry about FDIC limits, Max My Interest considers this in deciding where to optimize your accounts. Max My Interest charges 0.08% in annual fees (paid quarterly) for its services. One frustration with this service is the initial set up process. You essentially register for 5 different savings accounts for their banks (some use the same application) which can be time-consuming and confusing to keep track of.  Paycheck City This final tool helps you estimate what your paycheck will be under different circumstances. Maybe you just changed jobs and would like to see what to expect in a paycheck from your new company, or perhaps you would just like to see what happens to your take-home pay if you change your withholding from 2 exemptions to 3 exemptions. Again, one of the great features of this tool is the flexibility in how many variables you can enter. You can (and should) input how much you are putting into your retirement plan and what is being deducted for your benefits, and it will take this into consideration in the calculations. It can also calculate how much you will be withholding for taxes throughout the year. I’m a big fan of anything that help remove stress from my clients’ life, and I have seen that happen with these tools. With many of them being easily available and free, I would recommend giving them a test run. If you have other suggestions for technology tools that have worked well for managing your finances, let me know at [email protected], I would love to check it out. Like this blog post? Check out these pages...Comments are closed.

|

|

1701 W Northwest Hwy Ste 100

Grapevine, TX 76051 640 Taylor Street Ste 1200 Fort Worth, TX 76102 (817)-799-7699 |

|

© 2023 Flourish Financial Planning, Inc.. All rights reserved.